pay estimated indiana state taxes

Find Indiana tax forms. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Access INTIME at intimedoringov.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. 323 statewide flat rate counties may charge additional rates Sales tax. Make a payment online with INTIME by electronic check bankACH - no fees or. Mail your SC1040ES and payment in one envelope.

Indiana state income tax Indiana has a population of over 6 million 2019 and nearly 17 of the states non-farm workforce is employed in manufacturing the highest of any state in the USA. That means no matter how much you make youre taxed at the same rate. Find Indiana tax forms.

We last updated the Estimated. To make an individual estimated tax payment electronically without logging in to INTIME. This option is to pay the estimated payments towards the next year tax balance due.

In Indiana taxpayers who have a history of paying estimated tax can use a preprinted estimated tax voucher provided by the Indiana Department of Revenue DOR. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. If the amount on line I also includes estimated county tax enter the portion on.

Click on Make Payment or Establish Payment Plan in the. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. This payment can no longer be made on DORpay due to the Indiana Department of Revenues modernization effort.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. If the amount on line I also includes estimated county tax enter the portion on. Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due.

Indiana Department of Revenue. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments. Your average tax rate is 1198 and your marginal tax rate is 22.

Estimated payments can be made by one of the following methods. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. In order to pay individual state of Indiana income tax please follow the following steps.

DORpay is a product of the Indiana Department of Revenue. Residents of Indiana are taxed at a flat state income rate of 323. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a.

This marginal tax rate means that. Know when I will receive my tax refund. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Estimated payments may also be made online through Indianas INTIME website. All counties in Indiana impose their own local. Know when I will receive my tax refund.

To make payments toward a previous tax year filing please select or link to the. 081 average effective rate. Select the Make a Payment link under the.

Indiana State Tax Quick Facts. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Where to mail 1040-ES Estimated payments.

If you did make.

Taxation Of Social Security Benefits Mn House Research

State Taxation As It Applies To 1031 Exchanges

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States Vary Widely In Number Of Tax Filers With No Income Tax Liability Tax Foundation

Dor Owe State Taxes Here Are Your Payment Options

Dor Keep An Eye Out For Estimated Tax Payments

Corporate Tax Rates By State Where To Start A Business

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

2022 Federal State Payroll Tax Rates For Employers

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Dor Owe State Taxes Here Are Your Payment Options

State Taxation As It Applies To 1031 Exchanges

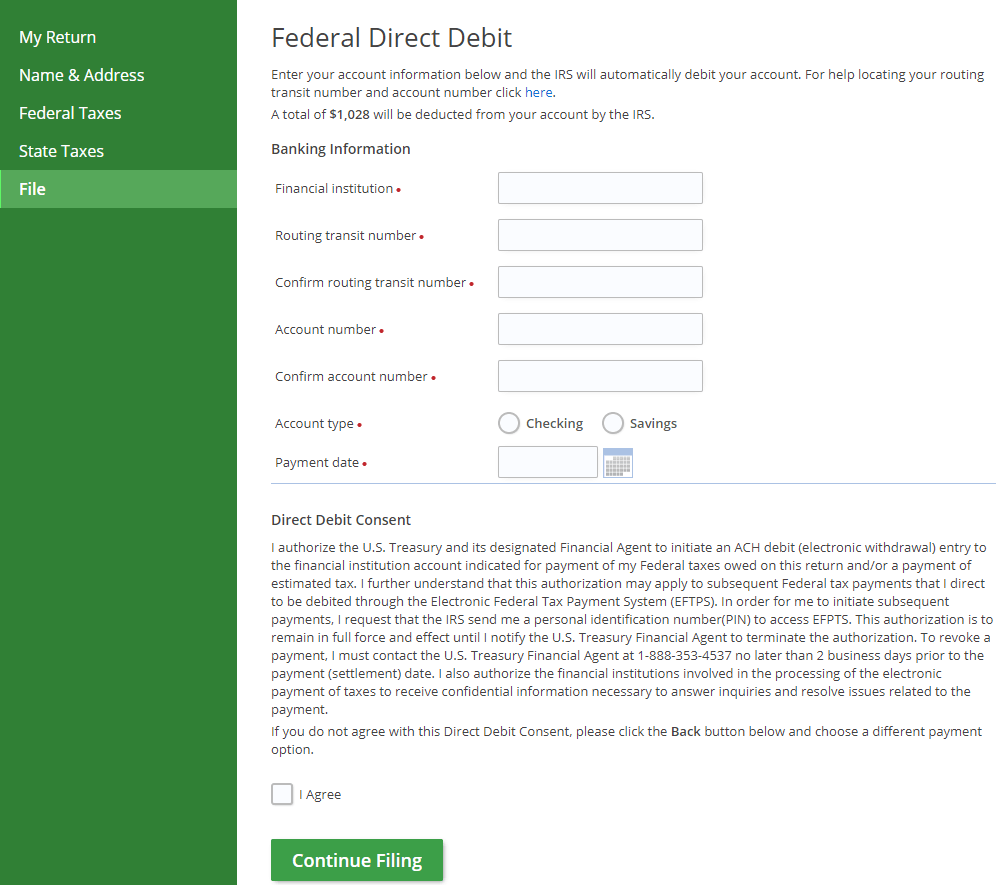

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic